NEWS & EVENTS

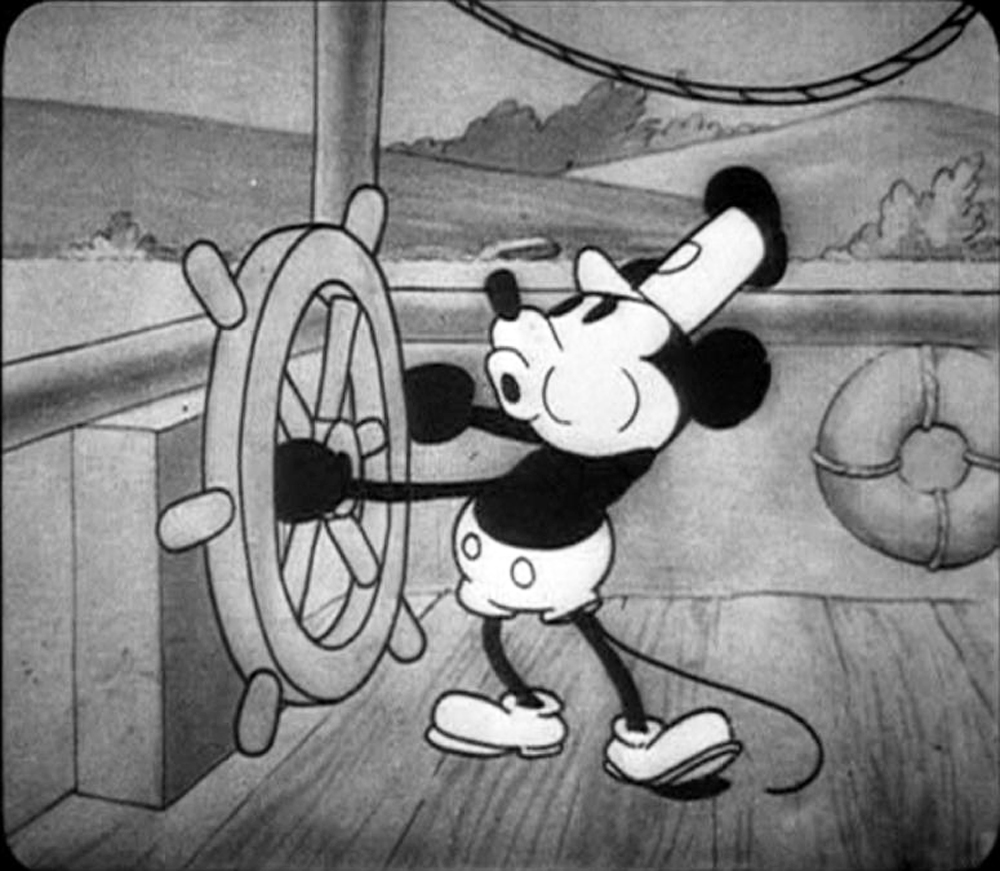

Mickey Mouse ‘Steamboat Willie’ Enters Public Domain: From Beloved Mascot to Blood-Thirsty Foe

Just hours after the classic film Mickey Mouse ‘Steamboat Willie’ enters public domain, a horror trailer featuring none other than the iconic Mickey Mouse hit the internet.

Read moreHow to get Wendy’s 1 Cent Burger – Jr. Bacon Cheeseburger: Score a Savory Deal

How to Get Wendy’s 1 Cent Burger – Jr. Bacon Cheeseburger Event: Score a Savory Deal. Burger lovers, rejoice! Fast-food giant Wendy’s is treating its customers to an irresistible offer this week. For a limited time, you can sink your teeth into a delicious Jr. Bacon Cheeseburger for just one penny!

Read moreTesla Recall 2023: Tesla Initiates Massive Recall for Autopilot Monitoring System

Tesla Recall 2023: Tesla Initiates Massive Recall for Autopilot Monitoring System.

Read moreARTS & Entertainment

ELECTRONICS & TECHNOLOGY

The Zelda Movie: Nintendo & Sony Takes The Legend of Zelda to the Big Screen

The Zelda Movie: Nintendo & Sony Takes The Legend of Zelda to the Big Screen. In exciting news for gamers and movie buffs alike, Nintendo has announced plans to develop a live-action film based on their beloved franchise, The Legend of Zelda.

HEALTH & FITNESS

The Importance of a Health & Fitness Planner: Unlocking Success

The Importance of a Health & Fitness Planner. In the hustle and bustle of modern life, maintaining good health and fitness often takes a backseat. It’s all too easy to get caught up in the daily grind and neglect the very foundation of our well-being.